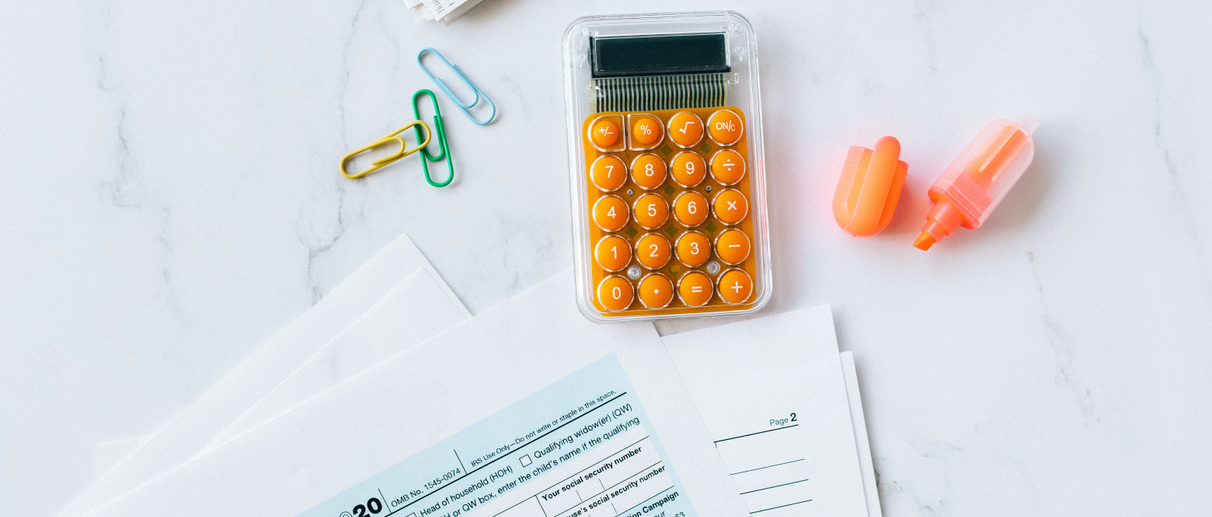

ARKAN CONSULTANTS

Providing trusted consulting services in Tax, Accounting, and AML Compliance across the UAE, with a focus on accuracy, compliance, and value.

1. Tax Advisory & Compliance We provide end-to-end tax services, including Corporate Tax, VAT registration and filing, Transfer Pricing, and audit support—ensuring compliance with UAE regulations while optimizing your tax position.

2. Accounting & Financial Reporting From bookkeeping to IFRS-compliant financial statements, budgeting, and audit preparation, we offer reliable accounting solutions tailored to your business needs.

3. AML Compliance Advisory We help businesses meet Anti-Money Laundering requirements through policy development, KYC framework design, FIU registration support, and internal training, ensuring full compliance with UAE AML laws.

About US

Welcome

My story

Comprehensive Services

Arkan Al Riyada offers expert Corporate Tax and VAT services

Corporate Tax and VAT services including registration, filing, and advisory.

Comprehensive business consulting, feasibility studies, and financial planning.

AML compliance solutions covering policy development, audits, and training.

Corporate governance and risk management advisory.

Representation and support during regulatory inspections.

Customized solutions to optimize tax efficiency and compliance.

Dedicated to helping your business grow sustainably and confidently.

Corporate tax

Corporate Tax services

Corporate Tax Registration – Assisting with new tax registrations and TRN acquisition.

Tax Advisory & Planning – Providing strategic advice to minimize tax exposure and ensure compliance with UAE Corporate Tax Law.

Preparation & Filing of Tax Returns – Accurate calculation and submission of annual tax returns within statutory deadlines.

Tax Compliance Reviews – Reviewing accounting and tax records to identify compliance risks and ensure correct application of tax rules.

Assessment of Capital Allowances & Depreciation – Reviewing fixed assets for correct tax treatment.

Tax Loss Utilization – Reviewing carried-forward tax losses for eligible offsets.

Transfer Pricing Compliance – Preparing transfer pricing documentation and ensuring transactions align with the arm’s length principle.

Representation before Authorities – Managing communication with the Federal Tax Authority (FTA) during queries, audits, and disputes.

Tax Group Structuring – Advising on tax grouping benefits and managing related compliance.

Services

Tax Planning Consultation

AML Compliance Review

Financial Reporting Services

Auditing and Assurance

Tax Return Preparation

AML Training and Education

Tax Planning Consultation

Our clients

Alex Carter

Book online now

About me

Welcome

Alex Carter

Featured items

Everyone’s favourite

Featured Item 1

Featured Item 2

Featured Item 3

Featured Item 4

Contact me

Have a question?

Contact me whenever you have any questions. I am always here for you!

Services

Tax Planning Consultation

AML Compliance Review

Financial Reporting Services

Auditing and Assurance

Tax Return Preparation

AML Training and Education

Corporate Tax Compliance

Risk Assessment and Mitigation

AML Compliance Review

Financial Reporting Services

Auditing and Assurance

Tax Return Preparation

Tax Planning Consultation

AML Compliance Review

Financial Reporting Services

Auditing and Assurance

Tax Return Preparation

AML Training and Education

Corporate Tax Compliance

Risk Assessment and Mitigation

AML Compliance Review

Financial Reporting Services

Auditing and Assurance

Tax Return Preparation

Tax Planning Consultation

AML Compliance Review

Financial Reporting Services

Auditing and Assurance

Tax Return Preparation

AML Training and Education

Corporate Tax Compliance

Risk Assessment and Mitigation

AML Compliance Review

Financial Reporting Services

Auditing and Assurance

Tax Return Preparation

Contact me

Have a question?

Contact me whenever you have any questions. I am always here for you!